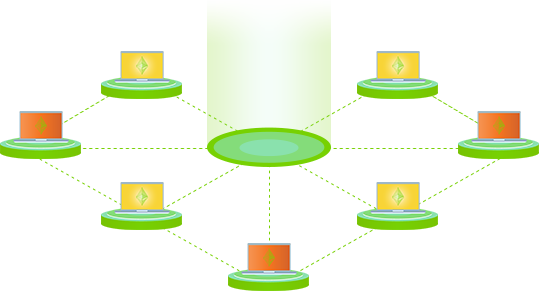

DevBotAI leverages market inefficiencies and suggests the establishment of decentralized vaults on Arbitrum, resulting in a 49.2% APY while maintaining minimal risk.

The motto is simple: Your keys, Your Crypto.

Leveraging the best of Arbitrum ecosystem.

| Strategies | Grid | Gap 3.5 |

|---|---|---|

| Step Distance | Manual | Automatic |

| Grid Structure | Simple Grid | Multidimensional Grid |

| Pairs | One Pair per grid | Multiple Pairs (whole portfolio) |

| Manual Trading | Will harm portfolio | Will automatically adjust |

| Risk | Higher | Lower |

| Returns | Lower | Higher |